An overview of energy efficiency grants for window replacement in 2025

Rising heating and cooling costs have made window upgrades a common part of energy-efficiency planning. In 2025, financial support may come through public grants, tax credits, and utility programs, often tied to measurable performance improvements. Understanding typical program structures and eligibility rules can help households estimate the potential value of upgrading to modern, efficient glazing.

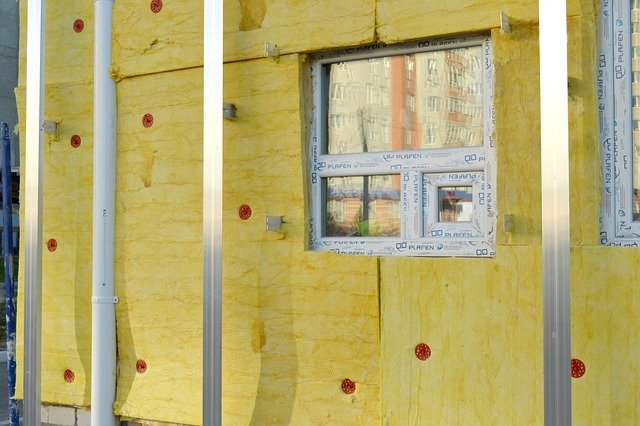

Replacing older windows is often framed as a comfort upgrade, but many public and utility-backed schemes treat it as an energy measure that can reduce heat loss, air leakage, and peak cooling demand. In 2025, support remains highly location-dependent, and it is frequently linked to verified product performance, installation standards, and sometimes whole-home retrofit planning rather than a simple like-for-like swap.

Typical grant programs and funding available for window replacement in 2025

Across many countries, “grant” is used broadly to describe several funding routes: direct subsidies, tax credits/deductions, low-interest loans, and utility rebates. Window replacement is commonly funded when it is expected to improve the building envelope, for example by moving from single glazing to double or triple glazing, adding low-emissivity coatings, or improving frame performance and air tightness. Solar-control or “solar” glazing (designed to reduce unwanted heat gain) may also qualify when it meets the scheme’s efficiency criteria.

In practice, the most common structures include: (1) tax-based incentives that reimburse a percentage of eligible costs up to a cap, (2) income- or vulnerability-tested programs that cover a larger share of costs for qualifying households, and (3) “whole-home” retrofit programs where windows are one eligible measure among insulation, ventilation, and heating upgrades. Many programs also require that products meet a recognized performance label or standard and that installers follow approved methods.

Common eligibility requirements linked to energy performance improvements

Eligibility typically centers on proving that the new windows materially improve energy performance rather than simply replacing damaged units. Programs may reference performance metrics such as U-factor/U-value (heat transfer), solar heat gain coefficient (SHGC or g-value), air leakage ratings, or compliance with local building-energy codes. Some jurisdictions require that the selected windows fall within a defined efficiency class or carry a government-recognized label.

Administrative requirements are also common. Applicants may need itemized invoices, proof of property ownership or primary residence, product documentation, and confirmation that installation was performed by a qualified contractor. Some schemes require pre-approval before work starts, while others operate on a reimbursement basis. Whole-home programs can add steps such as an energy assessment (sometimes before and after), a list of approved measures, and limits on combining multiple incentives for the same item.

Potential benefits of energy-efficient window upgrades and associated incentives

Beyond the grant itself, high-performance windows can reduce drafts, mitigate condensation risk on colder surfaces, and help stabilize indoor temperatures. In cooling-dominated climates, solar-control glass can lower peak heat gain and improve comfort near large glazed areas. In heating-dominated climates, better glazing and frames can reduce steady heat loss, especially when paired with proper air sealing around the window opening.

Real-world cost and support levels vary widely. Installed window replacement commonly ranges from a few hundred to a few thousand US dollars per window depending on size, frame material, glazing type (double vs. triple), access, and local labor costs; full-home projects can therefore become a significant capital expense. Many incentive designs reflect this by using caps, percentage reimbursements, or targeted support for low-income households.

| Product/Service | Provider | Cost Estimation |

|---|---|---|

| Home improvement tax credit for qualifying windows (country-specific rules) | United States: Internal Revenue Service (Energy Efficient Home Improvement Credit, Section 25C) | Credit typically structured as a percentage of eligible costs, with an annual cap for windows; actual value depends on tax situation and product qualification. |

| Means-tested energy-efficiency retrofit assistance that can include windows in specific cases | United States: Department of Energy–supported Weatherization Assistance Program (administered via state/local agencies) | Often covers a substantial share of eligible measures for qualified households; project scope and covered items depend on local program rules. |

| Household renovation subsidy that may include window upgrades based on income and performance | France: MaPrimeRénov’ (administered by ANAH) | Assistance level is typically tiered by household profile and expected energy impact; support can be partial and may require approved contractors. |

| Building-efficiency subsidy/loan programs that can include window replacement as an envelope measure | Germany: Federal support for efficient buildings (BEG; administered via KfW/BAFA pathways) | Support is commonly offered as a grant and/or subsidized loan depending on measure and pathway; rates and ceilings can change by program year. |

| Obligations/utility-linked efficiency support that may fund fabric improvements for eligible households | Great Britain: Energy Company Obligation (ECO) framework (delivery via obligated energy suppliers and installers) | Funding is typically delivered as installed measures rather than cash; household contribution, if any, depends on eligibility and measure package. |

Prices, rates, or cost estimates mentioned in this article are based on the latest available information but may change over time. Independent research is advised before making financial decisions.

To maximize the chance that incentives translate into real savings, many programs favor “measurable” improvements: documented product ratings, correct installation (including flashing and air sealing), and in some cases complementary upgrades such as insulation or ventilation controls. This is important because poorly installed high-performance windows can underperform due to gaps, moisture issues, or thermal bridging around the frame.

It is also common for incentives to interact with broader policy goals, such as reducing peak electricity demand or improving resilience during heat waves and cold snaps. That is one reason some schemes emphasize solar-control performance in warmer regions (to reduce cooling loads) and very low U-values in colder regions (to reduce heat loss). When evaluating any program, check whether it rewards specific performance characteristics—such as low SHGC, improved air tightness, or particular certification labels—because these details can affect both eligibility and the final benefit.

In 2025, the practical takeaway is that “window replacement grants” rarely operate as one universal program; they are usually a mix of tax incentives, targeted social programs, and utility-backed funding, each with different documentation and technical thresholds. A careful read of eligibility rules—especially performance criteria and pre-approval steps—helps set realistic expectations about both out-of-pocket cost and the level of support that may be available.